In times of crisis or disaster, having a well-stocked emergency kit can be a matter of life and death. One essential component of an emergency kit is food that can sustain individuals and families for extended periods when access to fresh supplies may be limited. This comprehensive guide aims to provide valuable insights into the […]

Author: Tina R. Powell

Autoclaves: Effective Cleaning and Sterilization for Instruments and Supplies

Autoclaves have long been recognized as essential tools in ensuring effective cleaning and sterilization of instruments and supplies. These devices employ a combination of heat, pressure, and steam to eliminate microorganisms that may pose a risk of infection or contamination. For instance, imagine a scenario where surgical instruments are inadequately cleaned before being used on […]

Gloves in Instruments and Supplies: An Informative Overview

Gloves play a crucial role in various industries, particularly within the realm of instruments and supplies. Their usage serves multiple purposes, ranging from protecting sensitive materials to ensuring the safety of individuals handling potentially hazardous substances. For instance, consider the hypothetical scenario of a laboratory technician tasked with conducting experiments involving toxic chemicals. In such […]

Payment Plans: Instrument Financing

Payment plans, specifically instrument financing, have become increasingly popular in recent years as a means for individuals to affordably acquire musical instruments. For instance, consider the case of Sarah, a passionate violinist who dreams of owning a high-quality instrument but lacks the financial resources to make an upfront purchase. In such cases, payment plans offer […]

Emergency Blanket: Essential in Emergency Kits for Safety and Survival

In emergency situations, where individuals are exposed to harsh weather conditions or unforeseen circumstances, having the right tools and resources at hand can make a significant difference in ensuring safety and survival. One such essential item that should be included in every emergency kit is an emergency blanket. This article will explore the importance of […]

Disposables in Instruments and Supplies: An Informative Perspective

The use of disposables in instruments and supplies has become a prominent topic within the healthcare industry. In recent years, there has been a growing trend towards incorporating disposable materials as an alternative to traditional reusable instruments and supplies. For instance, let us consider the case of a busy hospital that previously relied on sterilizing […]

Disinfectant Wipes: The Essential Guide for Cleaning and Sterilization of Instruments and Supplies

The importance of proper cleaning and sterilization of instruments and supplies cannot be overstated in various industries, including healthcare, food service, and laboratory settings. Disinfectant wipes have emerged as an essential tool for achieving effective cleaning and sterilization outcomes due to their convenience and effectiveness. For instance, consider a hypothetical scenario where a hospital is […]

Financing Terms: Instruments and Supplies in Instrument Financing

In the realm of instrument financing, understanding the various terms and instruments is crucial for both buyers and sellers. From a buyer’s perspective, navigating the world of financing can be overwhelming without proper knowledge about different financial tools available. Conversely, sellers must have a comprehensive grasp on these financing terms to effectively cater to their […]

Gauze Pads: Essential First Aid Supplies for Effective Wound Care

Gauze pads are an indispensable component of any well-stocked first aid kit, playing a crucial role in the effective management and care of various types of wounds. With their absorbent properties and ability to promote wound healing, gauze pads offer a versatile solution for different stages of wound treatment. For instance, imagine a scenario where […]

Syringes in Instruments and Supplies: A Comprehensive Guide to Disposables

In the field of healthcare, syringes are indispensable tools used for various purposes such as administering medications and collecting blood samples. Their importance cannot be overstated, as they play a crucial role in ensuring patient safety and delivering accurate dosages. This comprehensive guide aims to provide an in-depth exploration into disposable syringes, focusing on their […]

Flashlight: A Crucial Tool in Emergency Kits

Flashlights are often overlooked as a crucial tool in emergency kits, yet they play a vital role in ensuring the safety and well-being of individuals during unexpected events. Consider the case study of Sarah, who found herself stranded in her car on a dark road late at night due to a mechanical failure. Without a […]

Antiseptic Wipes for First Aid: Keeping Instruments Clean and Safe

First aid is a crucial aspect of medical care, aimed at providing immediate assistance to individuals who have been injured or are experiencing sudden illness. One key element in performing effective first aid is ensuring that the instruments used in the process remain clean and free from harmful bacteria. Antiseptic wipes have emerged as a […]

Pricing Options in Instrument Financing: Instruments and Supplies Unveiled

The financing of musical instruments and supplies has become an essential aspect for many musicians, both aspiring and professional. When it comes to acquiring the necessary tools for their craft, individuals often face various challenges in terms of affordability and accessibility. This article aims to delve into the intricacies of pricing options available in instrument […]

Batteries: Essential Information for Emergency Kit Supplies

In times of emergencies and natural disasters, having a well-stocked emergency kit can make all the difference. Among the essential items that should be included in such kits are batteries. Batteries serve as reliable power sources for various devices, ensuring communication, illumination, and other critical functions when electricity is disrupted. For instance, consider a hypothetical […]

Microscopes: Lab Equipment for Precise Analysis

Microscopes have long been a staple in the field of scientific research, enabling scientists and researchers to delve into the microscopic world with unparalleled precision. With their ability to magnify objects up to thousands of times their original size, microscopes play a crucial role in various disciplines such as biology, chemistry, and materials science. For […]

Leasing Arrangements for Instrument Financing: Instruments and Supplies

Leasing arrangements for instrument financing have become increasingly prevalent in the realm of music education and performance. This article delves into the various aspects of these leasing agreements, focusing specifically on instruments and supplies. To illustrate the significance of such arrangements, let us consider a hypothetical scenario: A talented young musician wishes to pursue their […]

Bandages: An Informative Overview in Instruments and Supplies>Disposables

Bandages are an essential component of medical care, used to cover wounds and promote healing. They come in a variety of forms, including adhesive bandages, gauze pads, and compression wraps. Understanding the different types of bandages available is crucial for healthcare professionals, as it allows them to select the most appropriate option based on the […]

Flasks: Essential Lab Equipment for Instruments and Supplies

Flasks are a fundamental component of laboratory equipment, serving as essential vessels for the containment and manipulation of various substances. With their versatile designs and functionality, flasks play a crucial role in scientific research, allowing scientists to conduct experiments and carry out measurements with precision and accuracy. For instance, imagine a scenario where researchers aim […]

First Aid in Instruments and Supplies: An Informative Guide

First aid is a crucial skill that can save lives and minimize the severity of injuries in various emergency situations. While most people are familiar with providing first aid to individuals, it is equally important to understand how to administer first aid to instruments and supplies. This informative guide aims to provide a comprehensive overview […]

Inventory Management in Instruments and Supplies: A Guide to Instrument Financing

Inventory management plays a crucial role in the success of businesses that rely on instruments and supplies for their operations. Efficient inventory management ensures that companies have the right amount of stock at the right time, minimizing costs and maximizing profitability. This article serves as a comprehensive guide to instrument financing, exploring various strategies and […]

Beakers: Essential Lab Equipment for Experiments and Analysis

Beakers are essential laboratory equipment that play a crucial role in conducting experiments and carrying out various forms of analysis. With their distinctive cylindrical shape, flat bottoms, and spouts for easy pouring, beakers provide researchers with a versatile tool to measure, mix, heat, or hold liquids during scientific investigations. For instance, imagine a chemist attempting […]

Gauze: Essential Information for Disposable Instruments and Supplies

Gauze is a widely used and essential material in the field of healthcare. It serves multiple purposes, including wound dressing, cleaning, and protection against contamination. This article aims to provide comprehensive information about gauze as an indispensable tool for disposable instruments and supplies. In one hypothetical scenario, imagine a patient who has undergone surgery and […]

First Aid Supplies: Essential Emergency Kits Instruments and Supplies

In emergency situations, having access to the right first aid supplies can mean the difference between life and death. Whether it is a minor cut or a major trauma, being equipped with essential emergency kits instruments and supplies is crucial for providing immediate care before professional help arrives. For instance, imagine a situation where an […]

Cleaning Brushes: Maintenance Tips for Instruments and Supplies

Cleaning brushes are an essential part of maintaining the longevity and functionality of various instruments and supplies. Without proper maintenance, these tools can quickly accumulate dirt, grime, and other contaminants that hinder their effectiveness. For instance, consider a scenario where a painter neglects to clean their paintbrushes after each use. Over time, dried paint residue […]

Instrument Financing: A Comprehensive Guide for Instruments and Supplies

The world of music is filled with the harmonious sounds produced by a vast array of instruments. From pianos to guitars, violins to trumpets, these tools allow musicians to express their creativity and connect with audiences on a deep emotional level. However, for aspiring musicians, acquiring high-quality instruments can often be an expensive endeavor. This […]

Cleaning and Sterilization for Instruments and Supplies: A Comprehensive Guide

In the field of healthcare, proper Cleaning and Sterilization of Instruments and supplies is of utmost importance to ensure patient safety and prevent the spread of infections. Imagine a scenario where surgical instruments used in a complex procedure are not adequately cleaned and sterilized between patients. The potential consequences could range from minor wound infections […]

Adhesive Bandages: Essential First Aid Supplies for Wound Care

Adhesive bandages play a crucial role in providing effective first aid for wound care. These small, self-adhering strips of material are designed to cover and protect minor cuts, abrasions, or other superficial injuries. They are widely recognized as an essential component of any well-stocked first aid kit due to their convenience, versatility, and effectiveness in […]

Centrifuges: Lab Equipment Essentials

Centrifuges: Lab Equipment Essentials In the world of scientific research and experimentation, laboratory equipment plays a crucial role in facilitating accurate results and advancing our understanding of the natural world. Among these essential tools is the centrifuge, a device used to separate substances based on their density through rapid spinning motion. Imagine a scenario where […]

Emergency Water: Ensuring Adequate Supply in Emergency Kits

In times of emergencies, access to clean and safe drinking water becomes a critical necessity. Whether it is a natural disaster such as an earthquake or hurricane, or a man-made crisis like a chemical spill or power outage, the need for adequate water supply cannot be overstated. This article explores the significance of including emergency […]

The Benefits of Burn Gel for First Aid: Instruments and Supplies

Burns are a common occurrence that can happen to anyone, anywhere and at any time. Whether it is a minor burn from accidentally touching a hot stove or a more severe burn caused by fire or chemical exposure, the importance of proper first aid cannot be overstated. One essential tool in the first aid kit […]

Sterilization Pouches: A Comprehensive Overview for Instruments and Supplies Cleaning and Sterilization

Sterilization pouches play a critical role in ensuring the cleanliness and sterilization of instruments and supplies used in various medical settings. These specialized pouches provide an effective barrier against contamination, preventing the entry of microorganisms during storage or transportation. To comprehend the significance of sterilization pouches fully, one can consider a hypothetical scenario: In a […]

Credit Requirements in Instrument Financing: What You Need to Know

Instrument financing can be a crucial step for musicians and aspiring artists looking to acquire the necessary equipment to pursue their craft. However, navigating through the credit requirements in instrument financing can often seem daunting and overwhelming. Understanding these requirements is essential in order to make informed decisions and secure favorable terms that align with […]

Needles: An Essential Guide for Disposable Instruments and Supplies

Needles are a fundamental component of medical and healthcare practices, serving as essential tools for various procedures such as injections, blood sampling, and intravenous therapy. The proper selection and use of disposable needles are crucial to ensure patient safety and optimize clinical outcomes. This article aims to provide a comprehensive guide on the characteristics and […]

The Essential Guide: Tweezers for First Aid

Introduction In the realm of first aid, where quick and efficient care can make a significant difference in the outcome of an injury or emergency, having the right tools at hand is paramount. Amongst these essential tools is a seemingly unassuming instrument that holds great utility: tweezers. With their slender, pointed tips and ability to […]

Lab Equipment: A Comprehensive Guide to Instruments and Supplies

The field of scientific research and experimentation relies heavily on the use of laboratory equipment. These instruments and supplies play a crucial role in facilitating various experiments, measurements, and analyses conducted by scientists, researchers, and students alike. Understanding the different types of lab equipment available is essential for anyone working in a laboratory setting to […]

Ultrasonic Cleaners: Essential Tools for Instrument Cleaning and Sterilization

Ultrasonic cleaners have become essential tools in the field of healthcare for effectively cleaning and sterilizing instruments. These devices utilize high-frequency sound waves to generate microscopic bubbles that create intense agitation, removing even the most stubborn contaminants from surfaces. For instance, imagine a scenario where a surgical instrument used during a complex procedure becomes contaminated […]

Sterilization Indicators: Instruments and Supplies Cleaning and Sterilization Explained

Sterilization indicators play a crucial role in ensuring the safety and effectiveness of medical instruments and supplies. With the increasing emphasis on infection control, proper cleaning and sterilization procedures have become paramount in healthcare settings. This article aims to provide a comprehensive understanding of the principles behind instrument and supply cleaning as well as sterilization, […]

Disinfectant Spray for First Aid: Keeping Instruments and Supplies Clean

In the field of first aid, maintaining cleanliness and hygiene is paramount to prevent infection and promote healing. One effective method for achieving this is through the use of disinfectant sprays. These sprays are specifically designed to kill or inhibit the growth of microorganisms on instruments and supplies, reducing the risk of contamination. For example, […]

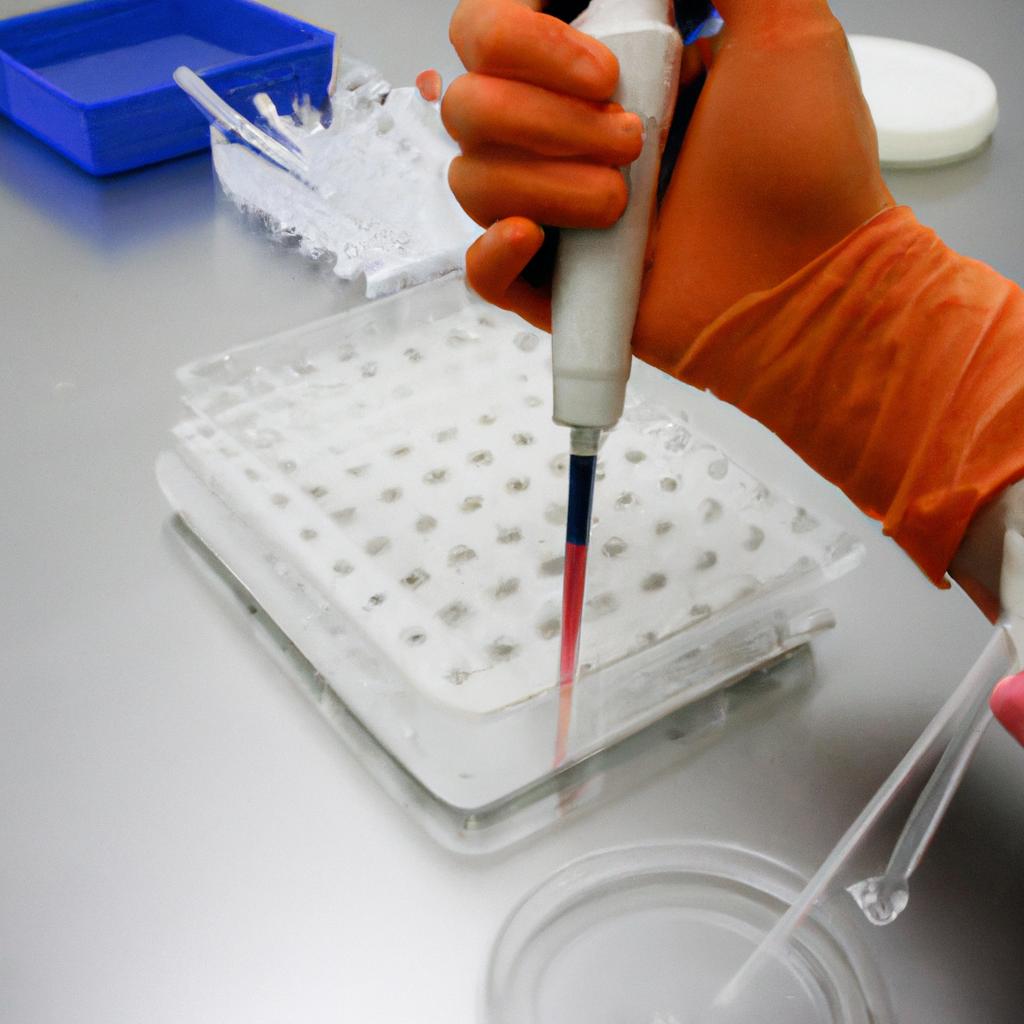

Pipettes: A Guide to Lab Equipment in Instruments and Supplies

Pipettes: A Guide to Lab Equipment in Instruments and Supplies Imagine a scenario where a researcher is meticulously measuring small quantities of liquid for an experiment that could potentially revolutionize the field of medicine. In this critical moment, precision and accuracy are paramount, and no other instrument can match the reliability of a pipette. The […]

Emergency Kits: Instruments and Supplies

In times of unexpected emergencies, having a well-prepared emergency kit can make all the difference in ensuring one’s safety and survival. Whether it be a natural disaster such as an earthquake or a man-made crisis like a power outage, being equipped with essential instruments and supplies is crucial. For instance, imagine being trapped in a […]

An Introduction to Spectrophotometers: Lab Equipment and Supplies

Introduction In the field of scientific research, the accurate measurement and analysis of light absorption and transmission is crucial for a wide range of applications. Spectrophotometers serve as indispensable tools in this regard, providing researchers with valuable insights into the properties of substances through their interaction with electromagnetic radiation. This article aims to provide an […]

Mask Disposables: Your Essential Guide

The use of disposable masks has become increasingly prevalent in recent times, particularly due to the ongoing COVID-19 pandemic. These masks serve as a vital protective measure against airborne pathogens and are widely used across various settings such as healthcare facilities, workplaces, and public spaces. This article aims to provide an essential guide on mask […]

Payday loans in Texas Help Your Finances Return to Normal

Are you now confronted with a situation that is capable of ruining your bank account? You might not think so in the midst of something that takes about $1,000 to address. But, think about how the smallest amount of money can cause an effect on your financial situation that can make you financially unsecure. This is why you […]